how do i get my employer to withhold more tax

Fill Out a New Form W-4. This usually happens only in special.

Tax Withholding Changes Can Boost Your Paycheck Kiplinger

With more people working from home over the past year this tax season has brought on some new changes and special requirements.

. Employers are required to withhold and pay personal income taxes on wages salaries bonuses commissions and other similar income paid to employees. If you notice that your W-2 shows. How to get this form.

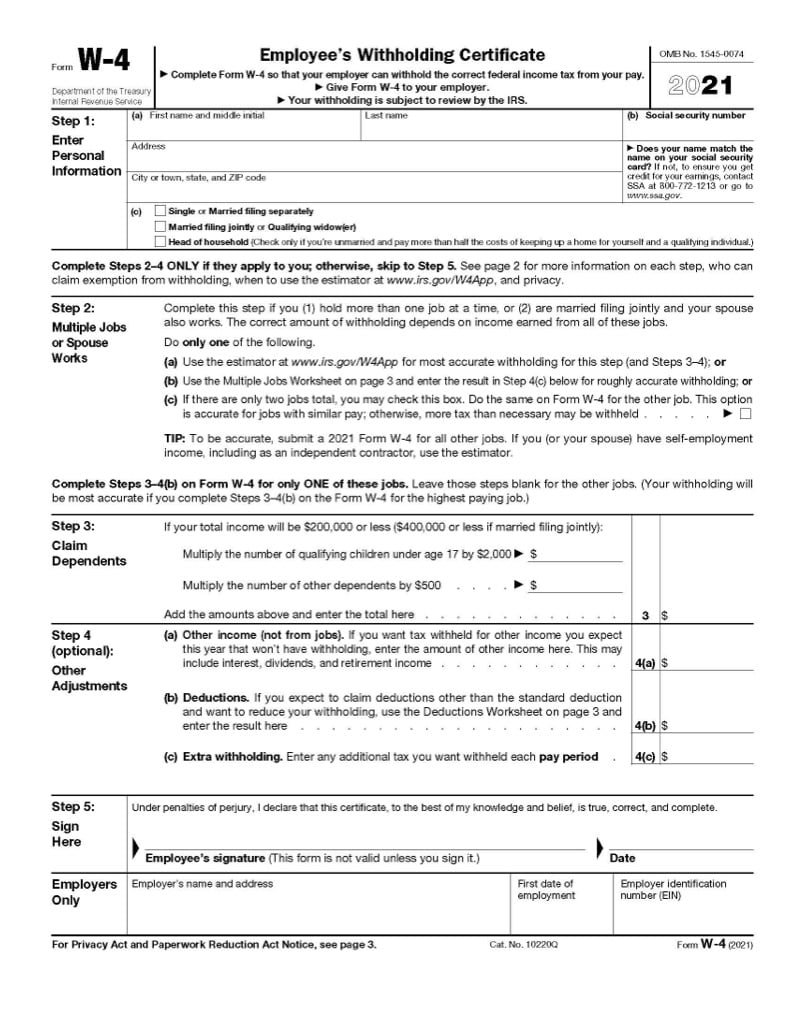

New Jersey gross income tax withheld from. Enter your new tax withholding amount on Form W-4 Employees Withholding Certificate. Determine if estimated tax payments are.

Certainly you should talk to your employer. Use the IRS Withholding Estimator to estimate your income tax and compare it. July 27 2022 1056 AM.

The employer may have made a mistake when. The changes to the tax law could affect your withholding. Increasing income tax deductions.

Ask your employer if they use an automated. To change your tax withholding amount. If you want to increase the rate or amount of withholding from your pay you can now do so by providing a written request for an upward variation to your payer.

To do this they have to give a federal. You can also use Form W-4 to request additional money be withheld from each paycheck which you should do if you expect to owe more in taxes than your employer would. Its possible that the employer didnt know what he was required to do especially if the employer is based out of state.

How can I get less withheld from my paycheck. Refer to Publication 15 and Publication 15-A Employers Supplemental Tax Guide for more information. Your payee must get our approval to reduce the amount you would normally withhold by completing a PAYG Withholding variation application.

Register for employer withholding tax online through the Online PA-100. You can use your American Express DiscoverNOVUS MasterCard or Visa credit card to pay your withholding tax liability. Answer 1 of 8.

Once youve used the Tax Withholding Estimator tool you can use the results of the calculator to fill out a new Form W-4. How to Check Your Withholding. Complete a new Form W-4 Employees Withholding Allowance Certificate and submit it to your employer.

Give it to your employers. Employers can file and pay employer withholding tax returns and submit W-2 information online using e-TIDES by. Credit card payments may be made through the Ohio Business.

Employees do not pay this tax or have it withheld from their pay. Make the form effective with the first wage payment. You need to submit a new W-4 to your employer giving the new.

All filers must file Form VA-6 Employers Annual Summary of Virginia Income Tax Withheld or Form VA-6H Household Employers Annual Summary of Virginia Income Tax Withheld. Complete a new Form W-4 Employees Withholding Allowance Certificate and submit it to your employer. However if you have no employer to withhold federal taxes then you will need to do this by making estimated tax payments.

Employees can choose to have more tax deducted from the remuneration they receive in a year. To adjust your withholding is a pretty simple process. Employers generally must withhold federal income tax from employees wagesTo figure out how much tax to withhold use the employees Form W-4 the appropriate.

485 22 votes. Complete a new Form W-4P Withholding Certificate for Pension or. There can be several reasons why no federal income tax was withheld from an employees payroll.

Employers are required to withhold New Jersey State income tax from the wages of your employees except Pennsylvania residents.

Income Taxes What You Need To Know The New York Times

What Do You Do With A W4 Tax Form Jackson Hewitt

Doordash 1099 Taxes And Write Offs Stride Blog

Learn About The New W 4 Form Plus Our Free Calculators Are Here To Help Paycheck Manager

Publication 505 2022 Tax Withholding And Estimated Tax Internal Revenue Service

2022 Federal State Payroll Tax Rates For Employers

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

How To Fill Out Irs Form W4 2022 With A Second Job Youtube

How To Complete 2020 New Form W 4 Payroll Tax Knowledge Center

Irs Revises Tax Year 2020 Withholding Form W 4 Yet Again Don T Mess With Taxes

How To Fill Out Irs Form W4 2021 Fast Youtube

Irs Form W4 Tax Adjustment Youtube

How To Fill Out A W 4 Form And Keep More Money For Your Paycheck Student Loan Hero

What Are Employer Taxes And Employee Taxes Gusto

New Confusing W 4 Form Is Coming For 2020 What To Do Now

How To File Your Taxes And Tax Tips For Part Time Workers

Which Employees Are Exempt From Tax Withholding

Explaining Paychecks To Your Employees

Everything You Need To Know About The New W 4 Tax Form Abc News